Why EOFY is a great time to purchase a new car

This is branded content for Driva.

As the end of the financial year hurdles towards us, so too do fantastic savings in the form of EOFY sales. Car manufacturers inundate us with attractive advertising and everyone is offering some sort of deal, telling us that now is the time to make the new car purchase we've been considering.

There are many compelling reasons to time your purchase strategically during the EOFY flurry, including multiple incentives that increase bang for your buck.

The question is - do they provide the value they say they will?

Discounts, add-ons and upgrades

The car industry is a competitive one at the best of times, with huge advertising budgets aimed at winning business in a landscape where customers are particularly valuable due to large profit margins.

In the lead up to EOFY, sales targets are increased and dealerships must entice customers, competing with great value, or not competing at all.

Car dealerships are eager to meet their sales targets at the end of the financial year, and to move old stock that they've struggled to sell. There are external pressures from auto wholesalers on dealerships to reduce the number of old stock they have on the showroom floor, to make room for the newest models that debut every new financial year.

"Dealers and their staff will normally be running to meet their end of financial year targets. So the later in June you're looking, the more likely you are to get a great deal. Ultimately, the more cars they sell in June the better, even if the dealers make less per car," said Driva co-founder, Scott Montarello.

"Not only are customers able to save money on the sale price of the car, which can be discounts of five to 20 percent off the original price, dealers are often happy to throw in extras like free servicing, extended warranties, window tinting, and spec upgrades like leather seats," said Mr Montarello.

Tax Benefits

For business owners and sole traders, the EOFY provides an opportunity to make informed purchasing decisions, with the objective of reducing impending tax bills.

In previous years, the Australian Taxation Office has only allowed business owners to claim the depreciation of vehicles used for work purposes. But the COVID19 pandemic resulted in many financial relief incentives for businesses, including temporary full expensing.

Temporary full expensing allows eligible businesses to claim an immediate tax deduction for the portion of an asset (ie. a car) used for business purposes, in the same year it is first used or installed ready for use, under a taxable purpose. To find out how this might be relevant to you and your business, visit the ATO website for further information.

Electric Vehicle Incentives

The recent surges in fuel prices are incentive enough for some shoppers to consider replacing their current car with an electric vehicle. Paired with the additional discounts that EOFY prompts from dealerships, those looking to make an EV purchase could reap the benefits and shave thousands off their costs.

"Just as with non-electric vehicles, there are major savings to be made when buying an EV during EOFY sales. For example, you might be able to get a discount on an EV charger or EV home installation costs," said Mr Montarello.

Electric vehicles are becoming more prevalent in the Australian market, and as some of the largest manufacturers have pledged to phase out the standard internal combustion engine by 2035, consumers are quickly getting on board.

For those in the EV market now - visit your local dealership and ask what current deals are available. Further savings can be made with an interest rate discount on EV loans from Driva.

Car Finance options for EOFY purchases

Financing a car is half the battle, and car dealerships are notoriously distrusted by consumers when it comes to snagging a good interest rate on a car loan.

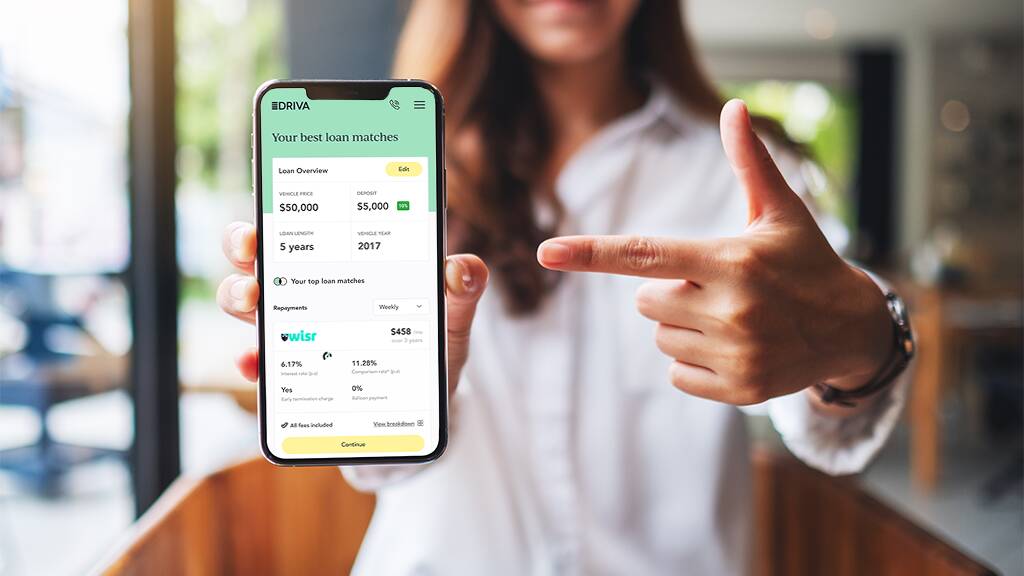

Driva allows car shoppers to maintain control of their own financing options, getting pre-approval from over 30 different lenders in a matter of minutes.

"Some dealerships will offer promotional rates on brand new vehicles to try and encourage you to buy from them and boost sales. But they usually make this money back on the cost of the vehicle, so it's important to keep this in mind when you're shopping around."

"This can mean that although it sounds like a great finance deal, you may have just lost your ability to negotiate more on the price of the vehicle - ultimately leading to you paying more in total. With Driva, you're able to compare your finance options from more than 30 lenders, so you'll have the confidence of getting your best possible rate," said Mr Montarello.

Visit Driva to find your perfect loan match in minutes at www.driva.com.au/

This is branded content for Driva.